Growth and Competition’s Impact on Montana’s Construction Labor Market in 2025

The construction industry in Montana has seen significant growth in recent years, contributing to the state’s economic expansion. This growth sets the stage for various workforce challenges that impact project timelines, costs, and overall industry efficiency. Informed by robust workforce data tools, this article explores the issues facing Montana’s construction industry.

Construction Industry Growth in Montana

Montana has become a national leader in construction job growth, with employment in the sector increasing by 12.3% from February 2020 to February 2022 (Montana News). This growth trend has continued, with the state’s construction employment reaching 39,300 in recent months, marking a 6.5% increase over the past year (BLS Gov).

The construction industry’s expansion is driven by the need to ramp up housing capacity, install fiber infrastructure, and modernize water and sewer systems. These developments have positioned Montana as a crucial player in the national construction landscape (Montana News).

Workforce Challenges Amid Growth

While the rapid growth in Montana’s construction sector is a positive sign for the state’s economy, it also brings significant challenges. The surge in construction projects has created a high demand for skilled labor, putting a strain on the available workforce. This “good problem to have” highlights the need for effective strategies to attract, train, and retain skilled workers to meet the growing demands of the industry.

Job Postings, Competition, and Labor Demand

From January to May 2025, Montana’s construction sector saw 1,790 unique job postings. The competition among 442 employers has driven up the median posting duration to 28 days, compared to the regional average of 17 days. This extended duration means that construction companies in Montana experience delays in filling critical roles, directly impacting project timelines and overall productivity. When positions remain open longer, projects can stall, leading to increased costs and missed deadlines.

Over the past five years, labor demand in the construction industry has shown a consistent upward trend. In June 2019, there were approximately 400 postings, which increased to 683 by June 2024. This represents a 44% increase, indicating a growing demand for construction labor amidst steady industry expansion. This increase highlights the ongoing need for skilled labor and the pressure it puts on employers to find and retain qualified workers.

Wage Trends and Salary Expectations

Wages in the construction industry are on the rise, with the median advertised salary reaching $27.63 per hour, reflecting an 8.2% increase from December 2024 to May 2025. Additionally, data from the Federal Reserve Bank of St. Louis shows that total wages and salaries in Montana’s construction sector have steadily increased over the past few years, with a notable rise from $2,516,801 in Q1 2024 to $2,755,952 in Q1 2025 (FRED) (ALFRED).

However, many construction companies are behind the curve in understanding these wage changes for specific roles. This lag in wage adjustment can make it challenging for companies to attract and retain skilled workers, further exacerbating the workforce shortage. Companies need to stay updated on wage trends to remain competitive and ensure they are offering salaries that reflect the current market conditions (FRED) (ALFRED).

Regional Breakdown

Billings, Bozeman, and Kalispell accounted for a significant portion of the 1,790 unique job postings from January to May 2025, with 525, 339, and 325 unique postings respectively. This concentration of job postings indicates that these cities are major hubs for construction activity in Montana. For construction companies, this data highlights the competitive landscape in these regions. High competition for talent in these areas can lead to longer hiring times and increased wage pressures as companies strive to attract qualified workers.

Understanding the distribution of job postings helps construction companies strategize their recruitment efforts. In highly competitive areas like Billings, Bozeman, and Kalispell, companies may need to offer higher wages, better benefits, and more attractive working conditions to stand out. Additionally, they might need to invest more in advertising and recruitment campaigns to reach potential candidates effectively.

Top Occupations and Skills

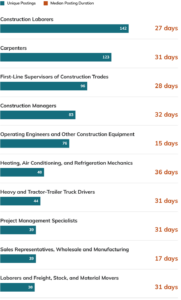

The top posted occupations in Montana’s construction industry from January to May 2025 are as follows:

This data highlights the critical roles and skills in demand, emphasizing the need for qualified labor in various areas of construction to meet project requirements and deadlines.

Common Challenges

- Skill Gaps: There is a significant gap between the skills employers need and those available in the workforce, particularly in project management and specific trades.

- Aging Workforce: Many skilled workers are nearing retirement, and there is a shortage of younger workers to replace them.

- Geographic Disparities: While cities like Billings and Bozeman have higher concentrations of job postings, rural areas struggle to attract skilled workers, causing delays and increased costs in less populated regions.

- Retention Issues: High competition among employers leads to frequent job changes and workforce instability, disrupting project continuity and increasing recruitment costs.

- Outdated Recruitment Practices: Many construction companies are behind the curve when it comes to modern recruitment methods. Utilizing digital platforms, social media, and other contemporary recruitment tools is essential for reaching a broader and more diverse pool of candidates.

Conclusion

Addressing workforce issues in Montana’s construction industry requires enhanced training programs, competitive wages, and improved recruiting practices. By focusing on these areas, Montana can ensure a steady supply of skilled labor to support its growing construction sector and sustain economic development.